Controller vs Accounting Manager: Time Management and Priorities in US Firms

controller vs accounting manager differ, and how do they manage their time effectively? Both roles are essential to financial stability, but their daily schedules, responsibilities

In US organizations, finance leaders often ask a key question: how do the priorities of a controller vs accounting manager differ, and how do they manage their time effectively? Both roles are essential to financial stability, but their daily schedules, responsibilities, and long-term priorities vary significantly. Understanding these differences can help businesses align financial operations with strategic goals, while also ensuring teams are efficient and compliant. This blog explores how controllers and accounting managers allocate their time, what their core priorities are, and why balancing both roles is critical for US firms in 2025.

Why Time Management Matters in Finance

Time is one of the most valuable resources in financial management. From month-end closings to compliance deadlines, missed tasks can result in penalties, inaccuracies, or delayed decision-making. For accounting managers, time management ensures that daily financial operations—like invoices and reconciliations—are completed without error. For controllers, effective time prioritization allows them to focus on oversight, analysis, and guiding executives with accurate data. In short, how these two leaders use their time directly impacts a firm’s ability to grow and remain compliant.

Controller vs Accounting Manager: Role Recap

Before diving into time and priorities, let’s briefly outline the roles:

Accounting Manager

-

Supervises daily accounting operations.

-

Ensures staff meet deadlines for accounts payable, receivable, and payroll.

-

Manages reconciliations, expense tracking, and monthly closings.

-

Reports directly to the controller or CFO.

Controller

-

Oversees overall financial management and reporting accuracy.

-

Maintains internal controls and compliance frameworks.

-

Prepares for audits and regulatory reviews.

-

Provides financial insights for budgets, forecasting, and strategic planning.

Both roles are intertwined, but how they allocate time to their responsibilities highlights their differences.

Time Management: A Day in the Life

Accounting Manager’s Day

An accounting manager’s schedule revolves around execution and team management. Priorities include:

-

Morning: Reviewing previous day’s transactions and delegating tasks.

-

Midday: Monitoring reconciliations, approving vendor invoices, and answering staff questions.

-

Afternoon: Preparing interim reports, checking compliance tasks, and troubleshooting operational issues.

Most of their time is spent on operational accuracy and ensuring that no detail slips through the cracks.

Controller’s Day

A controller’s day is broader, often focused on oversight and long-term impact. Priorities include:

-

Morning: Reviewing financial reports provided by accounting managers.

-

Midday: Meeting with CFOs or executives to discuss forecasts, budgets, and risks.

-

Afternoon: Overseeing internal controls, preparing for audits, and evaluating compliance gaps.

Controllers dedicate more time to analysis, communication, and strategic alignment rather than daily transaction monitoring.

Priorities for Accounting Managers

CFOs and executives expect accounting managers to focus on:

-

Accuracy of Transactions

Time is spent ensuring entries, invoices, and reconciliations are error-free. -

Meeting Deadlines

Payroll, month-end closings, and tax filings demand strict timelines. -

Team Management

Accounting managers must support staff, resolve issues quickly, and maintain productivity. -

Process Efficiency

Streamlining workflows—such as automating invoice processing—saves time and improves compliance.

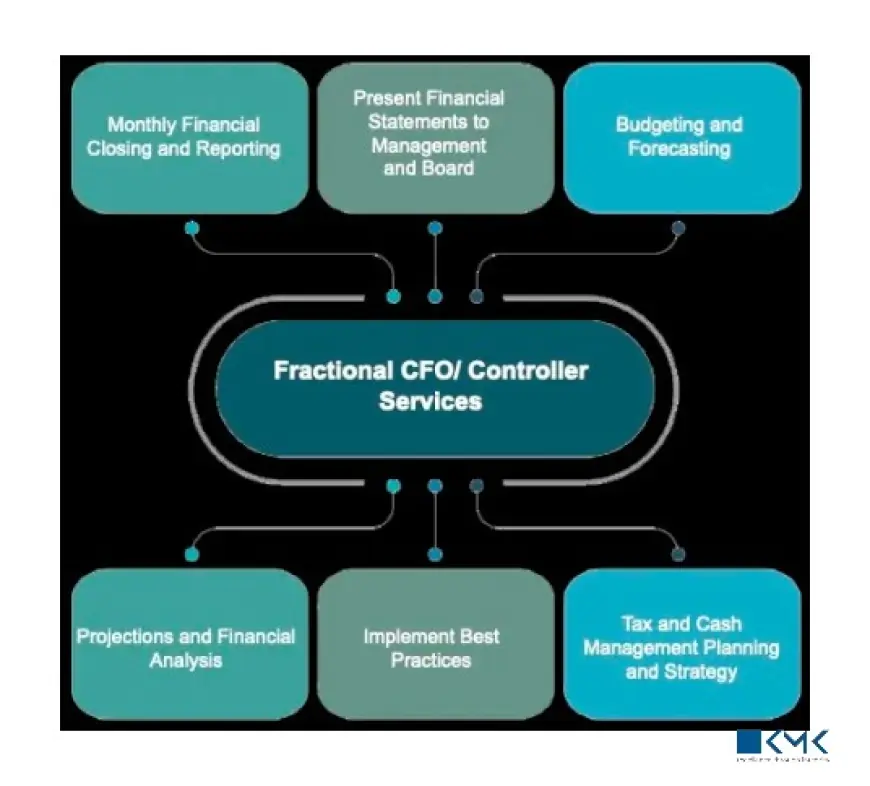

Priorities for Controllers

Controllers, on the other hand, focus on higher-level outcomes:

-

Oversight and Internal Controls

Controllers allocate time to monitoring policies and ensuring compliance with GAAP and regulatory standards. -

Budgeting and Forecasting

They dedicate hours to analyzing past performance and projecting future trends. -

Risk and Audit Preparation

Controllers spend significant time ensuring audit readiness and identifying financial risks. -

Strategic Communication

They collaborate with CFOs, department heads, and sometimes external stakeholders to align financial reporting with company goals.

Where Priorities Overlap

Though their focus differs, some priorities overlap between controllers and accounting managers:

-

Compliance: Both roles must ensure the firm adheres to tax, regulatory, and accounting standards.

-

Reporting: Accounting managers prepare reports; controllers analyze and validate them.

-

Technology Adoption: Both play roles in integrating systems like Xero or NetSuite for smoother operations.

Their collaboration ensures time is used effectively at both the operational and strategic levels.

Time Management Challenges

Despite their importance, both roles face challenges in managing priorities:

-

High Volume of Work: Accounting managers juggle multiple deadlines simultaneously.

-

Regulatory Pressure: Controllers must stay current on changing compliance requirements.

-

Technology Gaps: Outdated systems waste time and increase the risk of errors.

-

Role Overlap: Without clarity, controllers and accounting managers may duplicate efforts, wasting valuable time.

Overcoming these challenges requires clear role definitions, collaboration, and the adoption of modern accounting tools.

How US Firms Can Support Better Time Management

To maximize the value of both roles, US firms can:

-

Leverage Automation: Tools like cloud-based AP systems reduce manual work for accounting managers.

-

Clarify Responsibilities: Clear definitions of controller vs accounting manager roles prevent overlap.

-

Encourage Collaboration: Regular meetings ensure priorities align with company goals.

-

Provide Training: Keeping both roles updated on compliance and technology trends saves time in the long run.

Real-World Example

Imagine a US retail company preparing for year-end closing:

-

The accounting manager focuses on reconciling vendor accounts, finalizing payroll, and preparing reports.

-

The controller reviews these reports, ensures compliance with GAAP, and presents insights to the CFO about profitability and tax implications.

Without strong time management from both, the company risks delays, penalties, or missed opportunities for financial optimization.

Final Thoughts

The discussion of controller vs accounting manager is not just about role differences—it’s about how each manages time and sets priorities to keep a firm running smoothly. Accounting managers focus on operational execution, ensuring accuracy and deadlines, while controllers prioritize oversight, compliance, and strategy. Together, they form a balanced partnership that strengthens financial operations in US firms. When both roles manage their time effectively, companies benefit from accuracy, compliance, and strategic foresight—all essential for growth in 2025 and beyond.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0